StockX - Exploring the New Age of Reselling

Posted by Zhu Wang

Updated: Oct 18, 2019

Introduction

Data extracted for this project is scraped from https://stockx.com by using scrapy. You may find the codes here.

StockX is a popular e-commerce resale market place for sneakers, collectibles, streetwear, handbags, and watches. The purpose of this project is to explore sales trend on this website in order to provide insights for both individual sellers and potential investors.

Data extracted for this project is scraped from https://stockx.com by using scrapy. You may find the codes here.

A Bit of Background First

StockX is just one of the many resale market places that flourished in the recent year. The rise of this industry is prompted by a few factors. In recent year, mid to high-end retailers trying every trick in the book to stay relevant and remain profitable. They took a page of the playbook of fast fashion giants such as H&M and Zara, who continuously release limited quantity new products in effort to engage the consumers. Many mid to high-end retailers started to released limited edition products and collections that create the illusion of scarcity and exclusivity. In major US cities, the sighting of shoppers lining up for days outside of a store for a limited edition drop is commonplace. Resellers such as StockX is the manifestation of this supply economy phenomena, where sellers and buyers trade the latest and greatest items.

Data Collection

The below attributes are extracted for all products in the sneakers, collectibles, streetwear, and handbags categories. The total count is approximately 3,700 products.

- product title

- category

- annual sales quantity

- average sales price

- retail price

- resale condition

- description

- release date

Please note data related to watches was not extracted for this project.

Data Analysis

12 Month Financial Snapshot

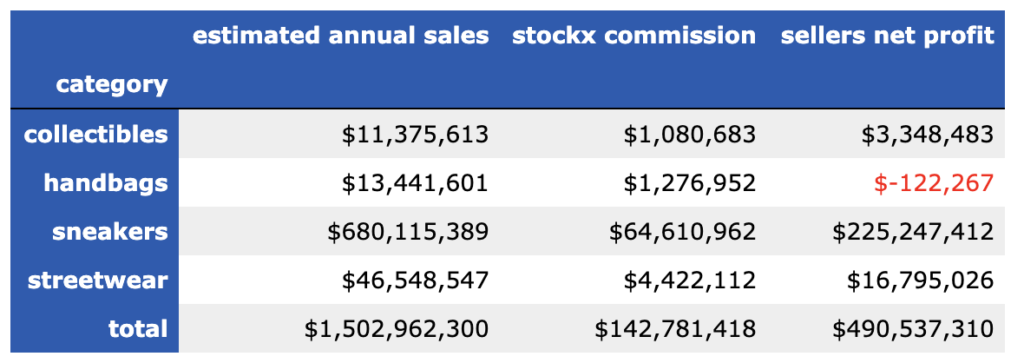

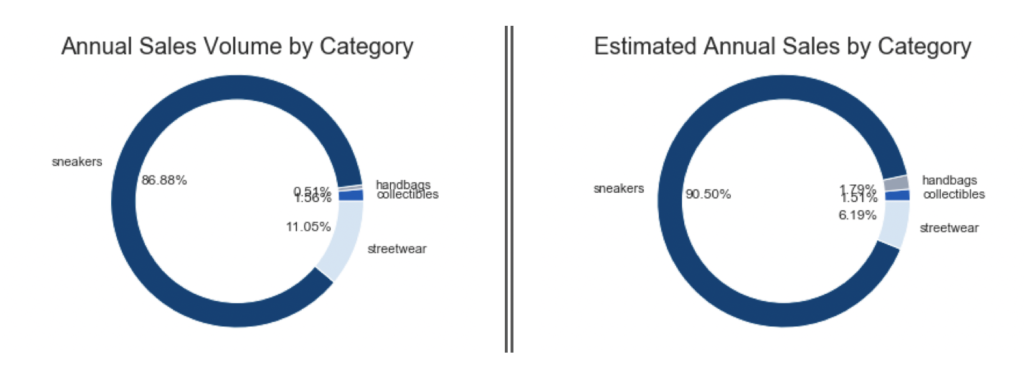

The below 12-month financial snapshot for StockX as of October 2019 is derived based on the data obtained.

Gross revenue - total volume of trading in the last 12 months.

StockX commission - commission fee collected by StockX based on an estimated 9.5% fee per sale.

Sellers net profit - sellers profit net of commission and fees.

The two takeaway from this preliminary analysis are as the following:

1. Sneakers generate the biggest volume of business from both StockX' and sellers' perspective.

2. StockX generates a significant amount of business, making it a prime candidate as an investment target.

The below illustrate average resale price, original retail price, average return on investment (ROI), and seller net profit on a per item basis for each category.

The following are observed:

1. Sneakers have the lowest average retail price and generate the highest average ROI. Sneakers also have the greatest spread on average ROI , which indicate that a seller may generate a significant ROI if they pick the correct products.

2. From first glance, it appears that an individual seller should consider investing in sneakers over the other categories. This will be further examined shortly.

3. Handbags generate a ROI that is <1.

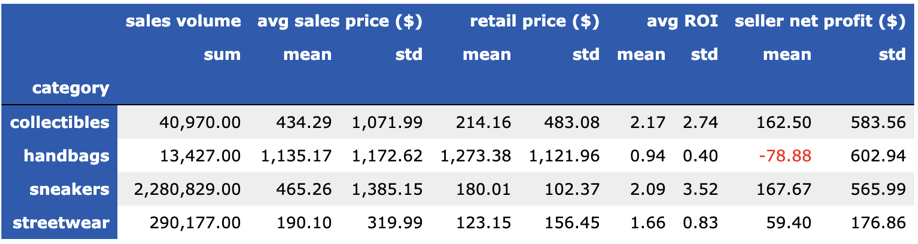

Product Condition

The below shows the breakdown of condition of products sold on StockX. All streetwear and sneakers traded are new. Nearly all collectibles are new. Lastly, all handbags are graded as pre-owned, which means they often resale below original retail price. These insights that could help new sellers make informed decisions when they curate a listing based on product type.

The Money Markers

Data collected revealed that certain sneakers and collectible items have a resale value that yielded a 20x-60x ROI.

Here are some examples:

https://stockx.com/nike-dunk-sb-low-staple-nyc-pigeon

https://stockx.com/bearbrick-kaws-chomper-1000-blue

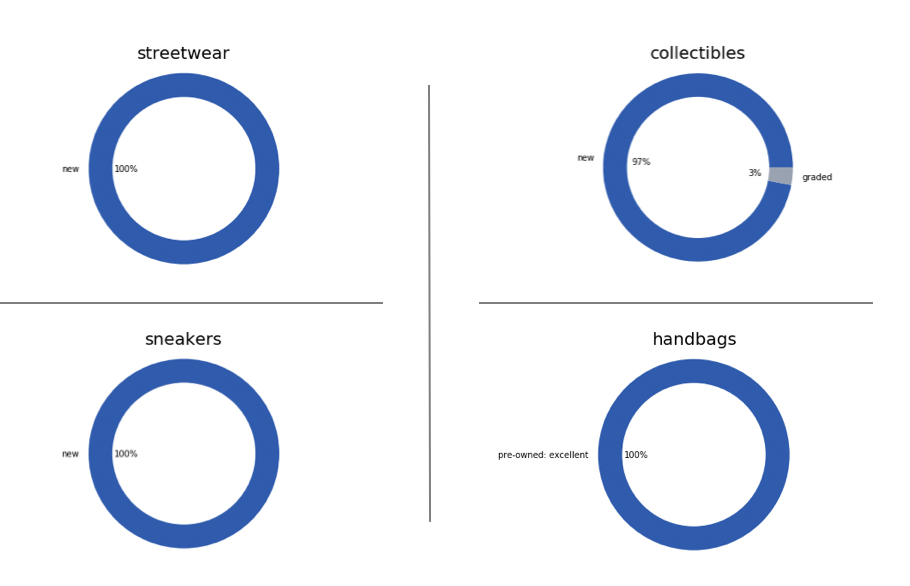

The log of average resale prices and average retail price (excluding outliers) for the different product categories are shown to the right. It is evident that the average retail prices for sneakers have the most narrow spread in comparison to the spread of average resale prices.

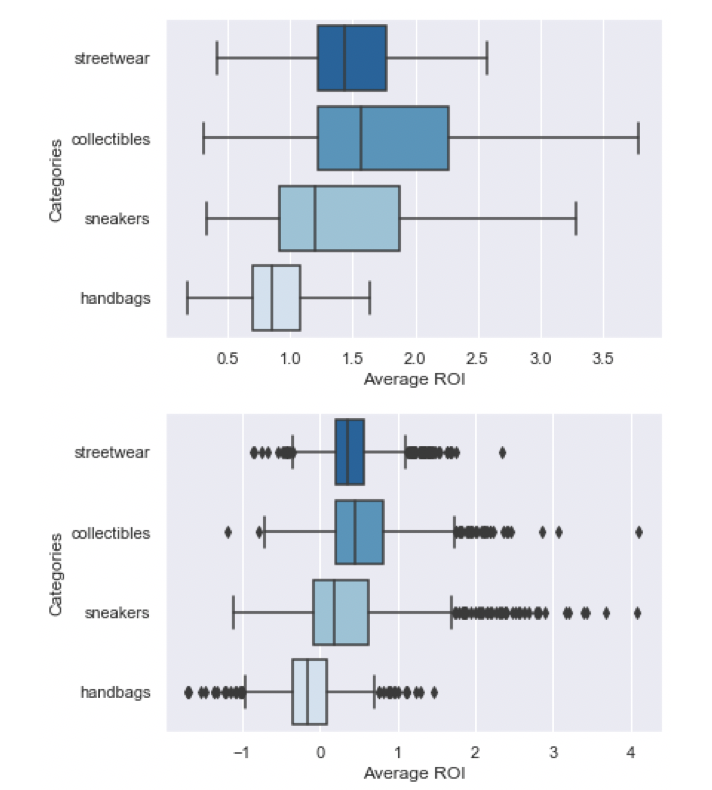

Graphs to the left shows log of average ROI with and without outliers for each product category. It is notable that sneakers appear to have the highest amount of outliers and a sizable interquartile range. This further indicates sellers may yield the best ROI in the sneakers category.

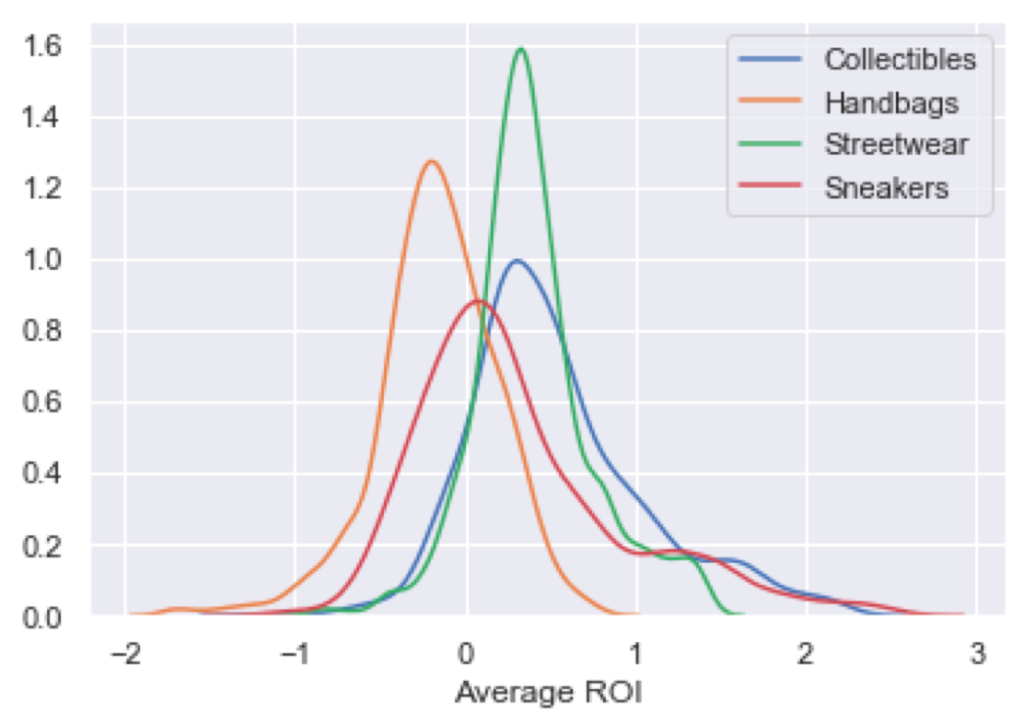

This density plot for average ROI (within 3 standard deviations) tells that there is a right skew for sneakers, which means sellers may find great investment opportunities in this category.

Sneakers

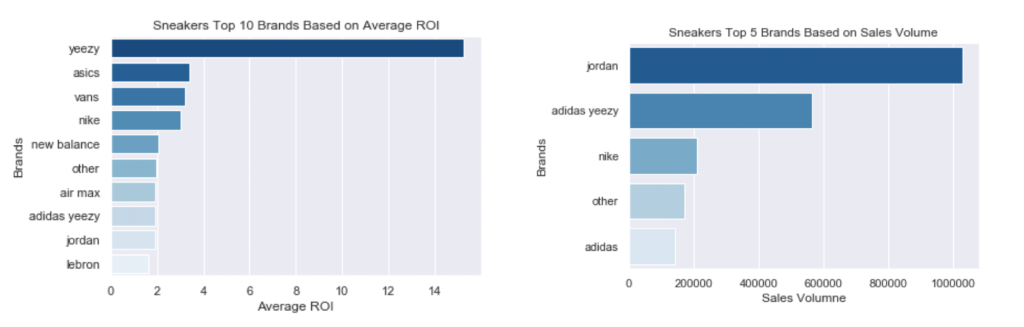

From the above analysis, it could be concluded that sneakers are the best investment to trade on StockX; therefore, further analysis on sneakers is warranted. The below show the brands/type of shoes with the highest average ROI in the past 12 months, as well as ones with the highest resale volume. This information can help sellers narrow down the types of shoes to invest in.

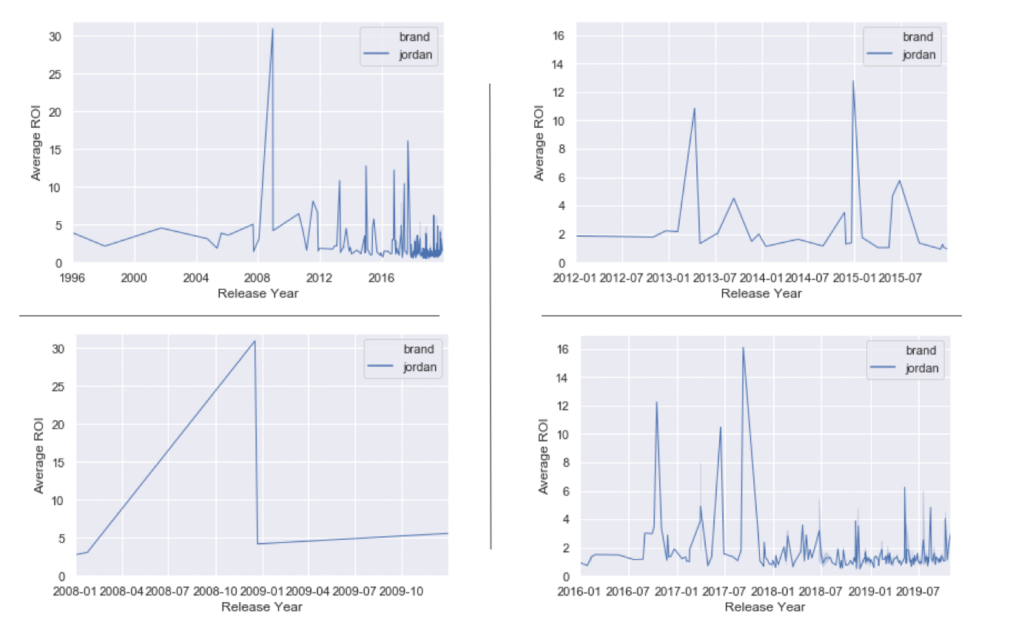

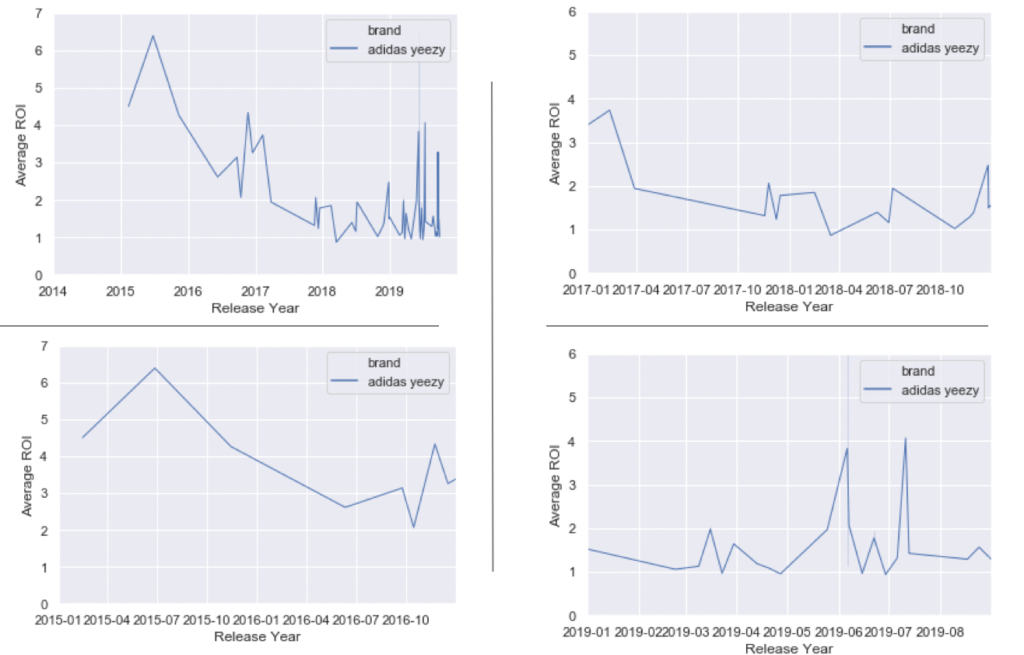

As an example to illustrate the application of data collected, the below are time series graph which the release dates that showed a spiked in average ROI for Jordan and adidas Yeezy. Sellers can use this information to hone in on the specific releases they should invest in to maximize profit.

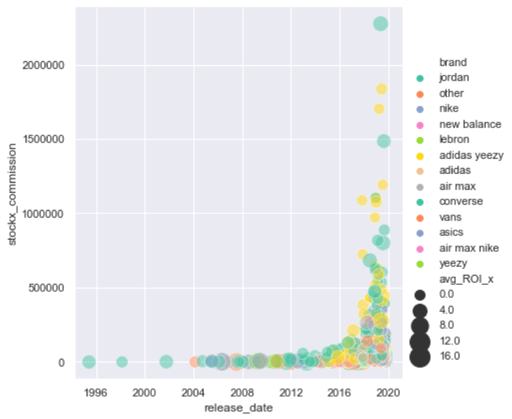

Lastly, the below graph shows StockX commission over a series of release dates. The different brands are represented by dots on the plot and the size of each dot is derived from average ROI.

This demonstrates a sharp rise in StockX fee income from the more recent releases. Although a topical examination of StockX's performance, the above data may be sufficient to pique third party investors' interest. Retailers who produced the items traded on StockX may also consider investing a resale business in order to absorb the derivative income generated from their products. On the other hand, retailers may also consider selling their exclusive releases directly on StockX and negotiate for a portion of the commission.

Conclusion

The main observation from this project are as the following:

- For individual sellers, reselling sneakers is the best entry into the resale game to maximize ROI.

- Third party investors - resale businesses such as StockX should be considered as an acquisition opportunity.

- Retailers featured on StockX - resale businesses should be considered as an acquisition opportunity and should also be considered as partners for collaborations.

Further Work

- Extract sales history data on each item in order to:

- understand which size or color yields the best ROI

- examine volatility in the resale market

- Use machine learning to predict the type of items that would generate the highest ROI

Zhu Wang

View all articlesTopics from this blog: Web Scraping