Real Estate and Machine Learning

Posted by Ted Dogan

Updated: Dec 2, 2019

Real Estate and Machine Learning

Presented at Tech Innovation Nation NY and NYCDSA

meetup.com/Tech-Innovation-Nation-NY

By Ted Dogan, Sam Audino, Alex Guyton

Special thanks to Sam Audino for his expertise and time dedicated to allowing this event and writing this post to flow seamlessly and deliver the content-rich experience for all who came.

Presentation: Through deep learning, data analysis and highly trained machine learning algorithms, real estate investing is transforming as we speak. We presented & discussed various topics within the realm of machine learning, data science & how it’s drastically changing the way real estate investors make decisions.

While the phrase may seem trite at this point, we live in an age of big data. It informs many marketing decisions across many platforms; data is bought and sold like oil commodities. However, one of the largest sectors of the economy, Real Estate (with nearly $30 Trillion in assets), has remained relatively untouched. Few companies have made their weight in gold utilizing data collected on homes, for instance Zillow, that realtors have always used. Common statistics of homes that we all look at even when buying: square footage, how many bedrooms, bathrooms, where it is located, among others. These have allowed us to build our own systems of reasoning of saying “Oh, that house is too expensive,” or “That house is underpriced.” With the incorporation of machine learning into this analysis we’re attempting to quantify system we have already built for ourselves; we wish to get it down onto paper in order to create a new tool to help us understand these interactions.

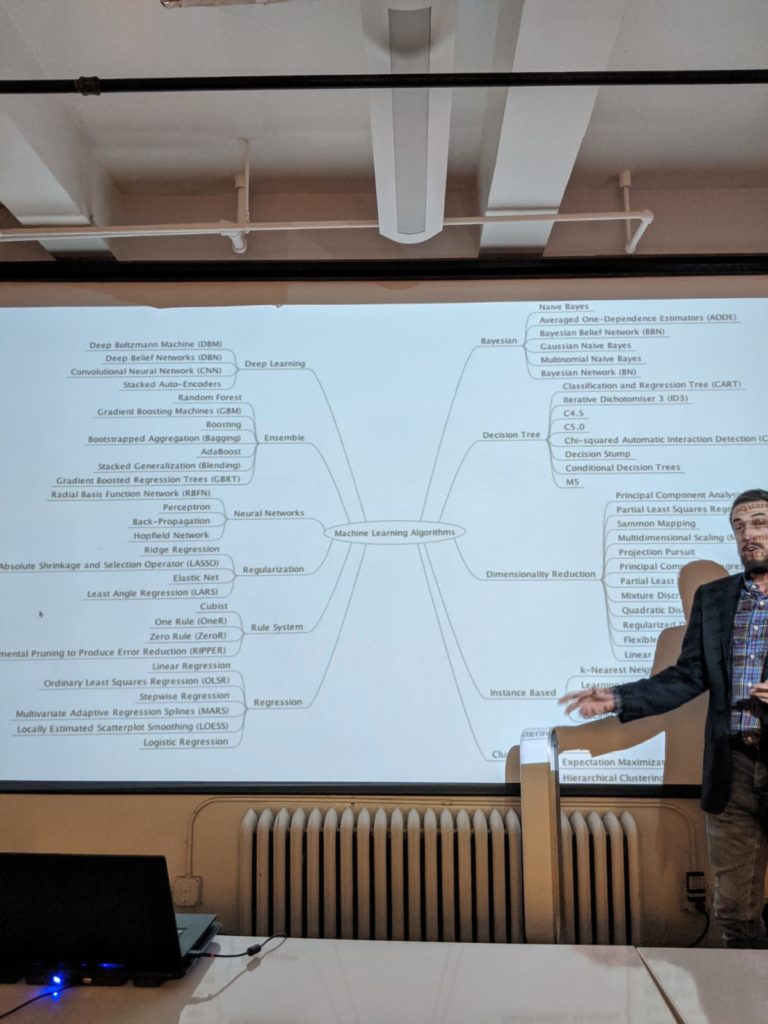

As machine learning becomes more popular, we have seen people applying these machine learning models to different projects. Through statistical methods we’ve been able to understand relationships in the data that a human eye would not be able to detect when walking around appraising the inside of a house. We can see how certain Features (a word we use in Data Science for the independent observations of our data set, or simply the things we base our predictions on) can be intimately related to one another. And with these models, people have been able to get very good estimations of the prices of these houses, some within a few thousand dollars. These predictions rely completely on the categorical (ex: does it have a garage? A pool?) and the numerical data (ex: square footage, number of bathrooms) in order to inform the decisions that they have made, but what if we could expand this reasoning?

Since there are relationships in the details of the house itself that are connected in ways that we could not understand we can also assume that there are qualities outside the home that also affect price. Things like air quality, online reviews, news and “hype” generated about a neighborhood, and local amenities that exists outside of the home are often left out of these models because they are hard to quantify. But being hard to quantify is not the same as being impossible to quantify. With the help of ever increasing computing power we’ve been able to pin down some of these aspects and incorporate them into our modeling process. This inventiveness has also been done in studies conducted by Tilburg University and MIT. We want to have our tool (the machine learning model) include these ideas because it brings us towards a more human way of understanding what we want out of a home, but it still misses an important factor that we’ve yet to talk about.

According to NAR (National Association of Realtors), around 50% of the time when a consumer looks at a house or an apartment, they are sold on the aesthetics of the home. “In addition, in the same survey, 78% of the time, home buyers responded that neighborhood quality is more important than the size of the home and 57% would forego a home with a large yard in favor of a shorter commute.” This is the mystical quality known in the industry as curb appeal. Currently the majority of the machine learning modelling done cannot capture what it means to see a place that you know you’d like to call home, and the model suffers for it; it is these unquantifiable features that could tune the accuracy of a model by a few percent. In the Real Estate sector, with the stated $30 Trillion in assets, even 1% (1% of $30 Trillion is $300 Billion) is nothing to laugh at.

But what if we could quantify this mythical curb appeal? What would that look like? Thanks to advancement in computing an emerging field of Computer Vision has come to help us with this problem. The idea is this: while the computer cannot on its own distinguish the difference between a picture of a cat and a picture of a dog, we can help it along by giving it a large number of images where a human says “this is a cat” or “this is a dog.” Almost in the same way a child learns, after seeing enough images labeled “cat” or “dog” the computer begins to get the hang of it. The actual process of labeling is more complicated than just saying “cat” or “dog,” however, as it relies on the human to label what features make the cat a cat (ears, nose, eye width, eye shape), and what makes a dog a dog. In a similar way, we’d like to utilize Real Estate experts to label a large set of houses to say “this is a nice house” or “this is a not so nice house.” They would label these images with the features that summarise this mythical curb appeal. With a large enough data set, the computer then would be happy to go along and continue classifying--with some oversight by the humans still, of course.

Researchers Paige, Law, and Russell (University of Cambridge, University College London, and University of Surrey, respectively) have stated that this will eventually be part of a 3 + 1 model, which are location accessibility, neighborhood amenity, structural features, and visual desirability. We, in describing this complex issue, dived even deeper. We are able to identify near 100 variables. And our analysis breaks it into 6 + 1.

- Extrinsic elements such as closeness to a park or public transportation

- Intrinsic elements such as square footage, number of bedrooms and bathrooms, and age

- Personal elements such as the personal income, marital status, smoking habits, personal credit score

- Economic indicators such as construction rate, jobs quality, sale volume, new residential permits

- Sharing economy such as impacts of Amazon delivery, Uber rides, and Airbnb rentals

- Textual elements such as reviews and news

- And finally, the visual aspects

At the end of the day, we look to this in order to increase the accuracy and information potential consumers could have when approaching the housing market. These models are once again tools, and as with any tool, they can be used to enhance or harm people’s lives. We hope that people would be able to use this improved model to protect themselves against predatory practices in the industry, as well as drive down costs of development and increase profit margins of investors. If you’d like to inquire to learn more about the project or are an expert in Real Estate who would be willing to help, please reach out to us.

Apply for the Upcoming NYC Data Science Bootcamp

The first step in becoming a data scientist is to complete your Data Science Bootcamp Application. Just click the button to apply. It's free and will only take you about 5 minutes.

Ted Dogan

With the right approach and tools, it is possible to create a digital footprint of behavior. Actions leave traces of preferences, a raw form of demand. Converting them into a meaningful business story is an art that requires experience and intuition. And that’s where I come in. I am currently working on teaching machine “this feels like home.” In addition to having over a decade of work/entrepreneurial/teaching experience, I hold a master’s degree in finance and bachelor’s in economics. For more, I can be found at linkedin.com/in/teddogan

View all articlesSubscribe Here

Posts by Tag

- Meetup (101)

- data science (68)

- Community (60)

- R (48)

- Alumni (46)

- NYC (43)

- Data Science News and Sharing (41)

- nyc data science academy (38)

- python (32)

- alumni story (28)

- data (28)

- Featured (14)

- Machine Learning (14)

- data science bootcamp (14)

- Big Data (13)

- NYC Open Data (12)

- statistics (11)

- visualization (11)

- Hadoop (10)

- hiring partner events (10)

- D3.js (9)

- Data Scientist (9)

- NYCDSA (8)

- Web Scraping (8)

- Career (7)

- Data Scientist Jobs (6)

- Data Visualization (6)

- Hiring (6)

- Open Data (6)

- R Workshop (6)

- APIs (5)

- Alumni Spotlight (5)

- Best Bootcamp (5)

- Best Data Science 2019 (5)

- Best Data Science Bootcamp (5)

- Data Science Academy (5)

- Demo Day (5)

- Job Placement (5)

- NYCDSA Alumni (5)

- Tableau (5)

- alumni interview (5)

- API (4)

- Career Education (4)

- Deep Learning (4)

- Get Hired (4)

- Kaggle (4)

- NYC Data Science (4)

- Networking (4)

- Student Works (4)

- employer networking (4)

- prediction (4)

- Data Analyst (3)

- Job (3)

- Maps (3)

- New Courses (3)

- Python Workshop (3)

- R Shiny (3)

- Shiny (3)

- Top Data Science Bootcamp (3)

- bootcamp (3)

- recommendation (3)

- 2019 (2)

- Alumnus (2)

- Book-Signing (2)

- Bootcamp Alumni (2)

- Bootcamp Prep (2)

- Capstone (2)

- Career Day (2)

- Data Science Reviews (2)

- Data science jobs (2)

- Discount (2)

- Events (2)

- Full Stack Data Scientist (2)

- Hiring Partners (2)

- Industry Experts (2)

- Jobs (2)

- Online Bootcamp (2)

- Spark (2)

- Testimonial (2)

- citibike (2)

- clustering (2)

- jp morgan chase (2)

- pandas (2)

- python machine learning (2)

- remote data science bootcamp (2)

- #trainwithnycdsa (1)

- ACCET (1)

- AWS (1)

- Accreditation (1)

- Alex Baransky (1)

- Alumni Reviews (1)

- Application (1)

- Best Data Science Bootcamp 2020 (1)

- Best Data Science Bootcamp 2021 (1)

- Best Ranked (1)

- Book Launch (1)

- Bundles (1)

- California (1)

- Cancer Research (1)

- Coding (1)

- Complete Guide To Become A Data Scientist (1)

- Course Demo (1)

- Course Report (1)

- Finance (1)

- Financial Data Science (1)

- First Step to Become Data Scientist (1)

- How To Learn Data Science From Scratch (1)

- Instructor Interview (1)

- Jon Krohn (1)

- Lead Data Scienctist (1)

- Lead Data Scientist (1)

- Medical Research (1)

- Meet the team (1)

- Neural networks (1)

- Online (1)

- Part-time (1)

- Portfolio Development (1)

- Prework (1)

- Programming (1)

- PwC (1)

- R Programming (1)

- R language (1)

- Ranking (1)

- Remote (1)

- Selenium (1)

- Skills Needed (1)

- Special (1)

- Special Summer (1)

- Sports (1)

- Student Interview (1)

- Student Showcase (1)

- Switchup (1)

- TensorFlow (1)

- Weekend Course (1)

- What to expect (1)

- artist (1)

- bootcamp experience (1)

- data scientist career (1)

- dplyr (1)

- interview (1)

- linear regression (1)

- nlp (1)

- painter (1)

- python web scraping (1)

- python webscraping (1)

- regression (1)

- team (1)

- twitter (1)